Procure to Pay refers to the process of purchasing and acquiring goods and/or services online. It involves integrating accounts payable and purchasing software to easily manage every step of the procurement process.

The most important element of a procure-to-pay strategy is good technology and software. Good software provides automation to streamline your process.

For example, Sysynkt can support your organisation through its true cloud experience and innovative procure to pay functionalities. Join BDI for a series of webinars demonstrating key Sysynkt features, including how Google AI is leveraged to automate invoice processing. Free tickets are available now via Eventbrite.

Table of Contents

Join the BDI mailing list

Keep up to date with the latest events, webinars, and product launches from BDI.

Sign UpKey terms

The Procure to Pay process involves a variety of key technical terms. An understanding of P2P solutions therefore heavily relies on understanding these key terms.

Requisitioning

This is the official order to request the use of something. For example, a team member raising an internal request for the purchase or supply of a specific good qualifies as requisitioning.

Approval

Senior team members must sign off requisition requests a junior staff member raises, known as approval. Approval indicates that the purchase is necessary and that the purchasing process should proceed.

Purchasing

Purchasing is the result of requisitioning. In traditional procurement processes, this step is usually completed by the purchasing department at the request of an end-user. However, it is important to note that this does not mean that the payment has occurred.

Receiving

This is when the good or service is delivered to the organisation. Typically, this occurs before payment within the procure-to-pay process.

Payment

In the business context, payment typically takes place once the goods or services have actually been delivered or received.

Accounting

Because this is a company payment with tax implications, accountants need to accurately keep records. They also must reconcile the transfer of funds with the original purchase order and approval.

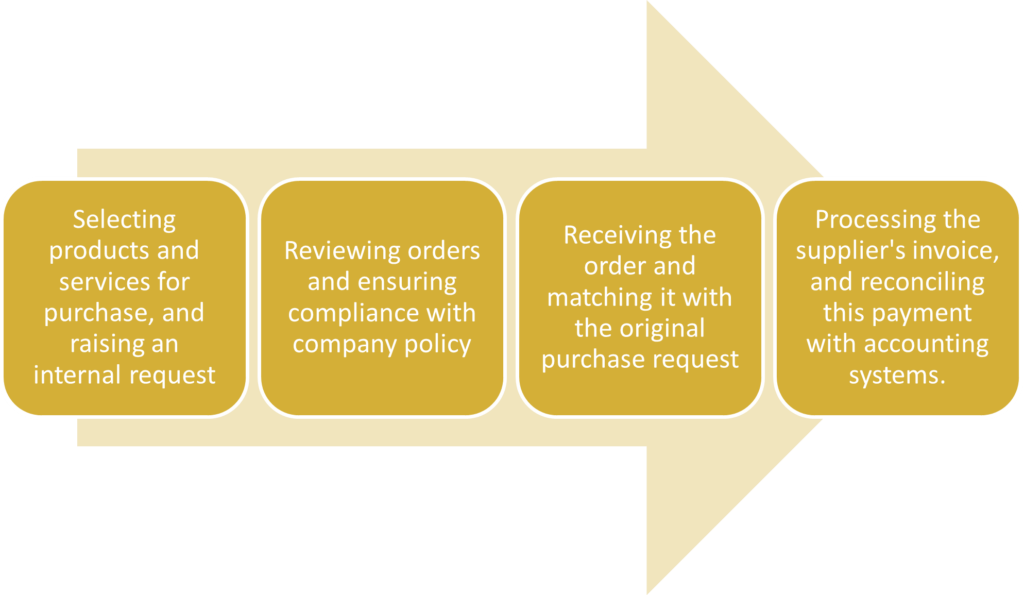

Four steps of Procure to Pay

Four simple steps form the Procure to Pay process. These are represented in the diagram below.

Good P2P software can automate elements of this process, reducing the amount of time spent by teams on administerial tasks. This provides numerous benefits to a business, such as active control over budgets, consolidating manual commerce processes to reduce errors, and streamline catalogue maintenance.

Benefits of Procure to Pay

Using a Procure to Pay solution offers a wide range of business benefits.

-

Streamline procurement processes

A key benefit of procurement software is that it provides connectivity throughout the organisation. Requisitions are therefore requested and approveed faster, appropriate suppliers are selected based on available data, and POs are produced and sent to suppliers.

-

Reduce invoice processing costs

Using digital invoices over paper options reduces invoice processing costs by up to 80%. This enables companies to use employees for more strategic initiatives, instead of repetitive admin tasks.

-

Gain 100% visibility

P2P solutions provide greater visibility throughout the supply chain. Both buyers and suppliers are therefore able to view invoice status in real-time.

-

Better management of exceptions

With more invoices processing more quickly, exceptions get the attention they deserve. This also means faster resolutions.

-

Capture data for better decision-making

Robust P2P solutions also offer robust on-demand reporting. Companies therefore gain greater control over cash flow and working capital as a result.

Summary

The Procure to Pay process is streamlined by using specific P2P software. Integrating accounts payable and purchasing software helps organisations easily manage each step of the procurement process. Choosing a good P2P software automates elements to free up time for team members to work on important tasks. A Procure to Pay process is only as strong as the solution behind it.

How BDI can help your organisation with Procure to Pay

Sysynkt’s Procure to Pay (P2P) module streamlines your expenses and invoices process, creating a pain-free and simpler solution for your organisation. The software brings SunSystems up to date by introducing modern technology to the software. For example, AI and document processing technology within Sysynkt automatically capture supplier invoices from your inbox and matches them against orders.

No matter what size, Sysynkt can meet your organisation’s needs through configuration. Whether you are a small charity with five users or a large multi-national with complex authorisation processes, Sysynkt can be configured for your needs. By removing the traditional user-based pricing, Sysynkt can be used by anyone within the organisation without worrying about massive increases in user costs.

If you believe Sysynkt is a good fit for your organisation, then please contact one of our sales team today for a consultation. We would welcome the opportunity to introduce this innovative new software solution to your organisation.

Alternatively, why not join us for a live demonstration of Sysynkt’s key features, including its purchase management functionality? Tickets are available below.

Download your free eBook: Sysynkt - A Brief Introduction

Find out more about Sysynkt’s features and learn how you can revolutionise your BI strategy with an FMS today.

Ready to start?

Our team of data intelligence experts are ready and waiting to work with your organisation

Recent Comments